How long have you been making transactions using cards or checks? Have you ever thought why you need an IFSC code? Why is this code mentioned on your checks, bank books and online transactions?

Let’s understand the reasons.

What is the IFSC?

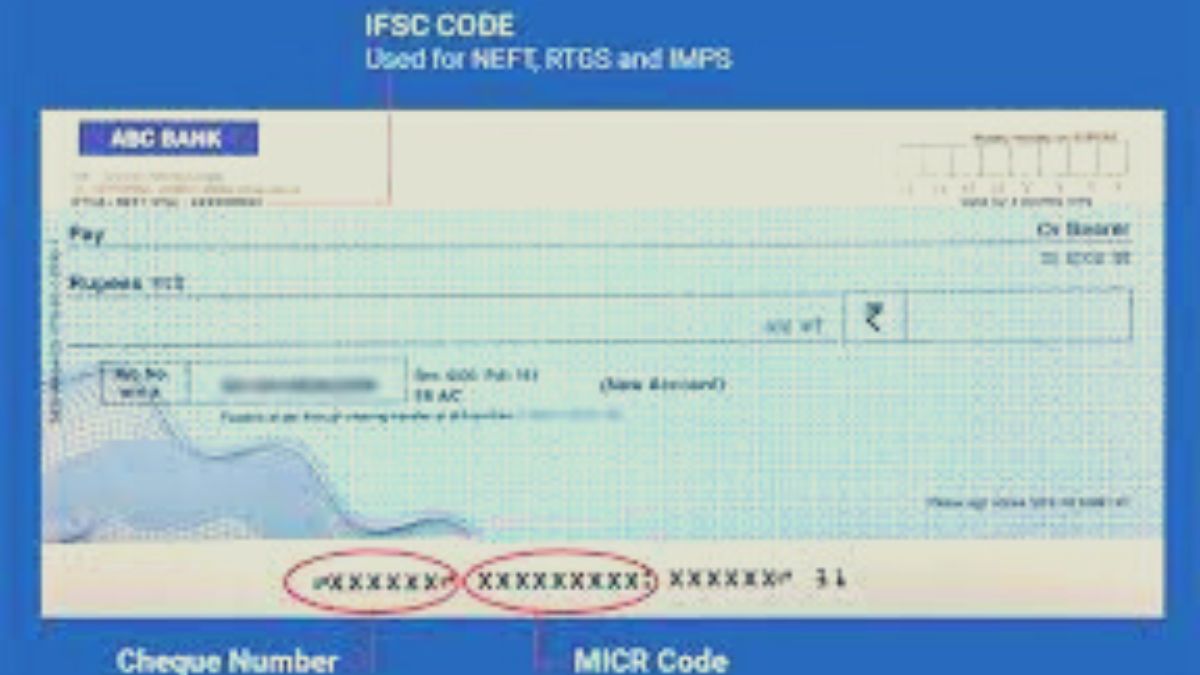

IFSC is an abbreviation of Indian Financial System Code. It is an 11-digit identification number. This number is specific to a single bank branch.

IFSC code consists of digits and letters. The Reserve Bank of India provides such code to bank branches.

The first four alphabetical characters of the code represent the bank. Next comes the number 0, and then the next six characters are numeric, however, they can also be alphabetical.

The IFSC code is required to process fund transfers for all payment modes. These may include CFMS, NEFT and RTGS.

The presence of the code ensures that the funds reach the correct destination bank, without any hiccups during the transaction process.

Now, transactions cannot be reversed automatically, so transferring money to the wrong bank causes several inevitable problems and inconveniences.

The IFSC code has reduced the hassle of going through long transaction processes. Gone are the days when money was sent through the local bank branch and then you had to go through the lengthy process of filling out the form and then depositing the amount into the beneficiary’s bank account.

The development of the Internet and its worldwide use has made it possible to send money through online means with the greatest ease and speed.

IFSC codes are essential to complete online transactions and ensure that the amount goes to the destination bank account.

Categories: Optical Illusion

Source: ptivs2.edu.vn